On a day when the stock market seemed shaken, the Dow Jones Industrial Average defied the odds and showed considerable strength. While many tech stocks, especially Nvidia, faced significant losses, the Dow managed to edge up, leaving investors pondering the wider implications of this unusual market behavior. Let’s dive into what happened and what it means for everyone watching the stock market closely.

Dow Jones Stands Out

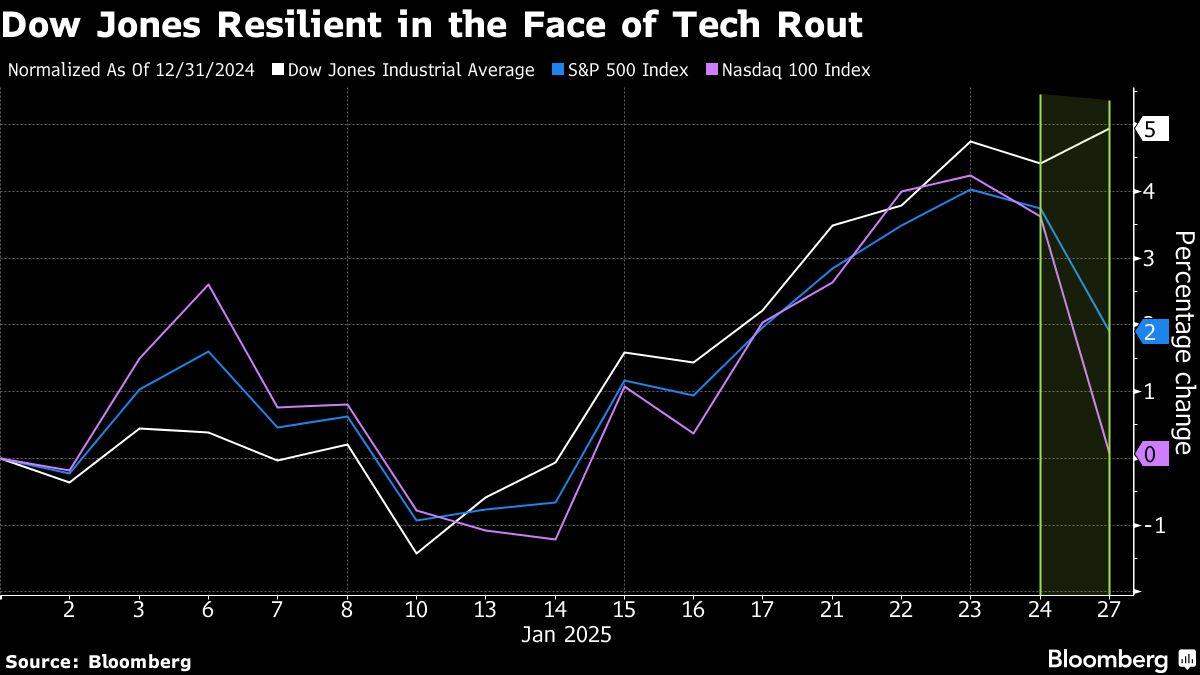

On Monday, the Dow Jones Industrial Average (DJIA) rose by an impressive 0.7%, even as broader indexes like the Nasdaq struggled. Companies such as Salesforce and Johnson & Johnson led the charge, each seeing their stock prices climb by at least 2.8%. This remarkable performance raises questions about why the Dow was able to weather the storm when its tech-heavy counterparts were not.

Nvidia’s Dramatic Losses

In stark contrast, Nvidia saw its stock plummet by over 17%, wiping out an astonishing $600 billion in market value. Many tech investors are worried about the implications of China’s new AI development, a model named DeepSeek. This new technology is reported to be able to perform similar tasks using cheaper resources, causing concerns among traditional tech giants struggling to keep up.

Broader Market Trends

The Nasdaq Composite took a heavy hit, dropping more than 3%, while the S&P 500 fell almost 1.5%. The divergence between these indexes and the Dow is notable, particularly as the last time this occurred was back in 1999. More than two-thirds of Dow components experienced increases, suggesting that some sectors are viewed as undervalued and less reliant on AI models like DeepSeek.

What is DeepSeek?

DeepSeek is an advanced AI system developed in China, which has raised eyebrows in Silicon Valley. This AI model claims to use less data and cheaper chips to achieve results comparable to leading US technologies. Investors are now reconsidering which companies will thrive in the future as AI technology evolves, particularly those adapting quickly to new developments like DeepSeek.

Investor Reactions

As news of Nvidia’s challenges spread, investors began retrenching, looking for safer places to put their money. Many turned to Treasury bonds, which have traditionally been seen as a safer investment during turbulent times. The yield on the 10-year Treasury note fell to its lowest point in over a month, indicating a flight to safety that often accompanies market distress.

Political and Trade Concerns

The market turmoil wasn’t just prompted by technological developments; political tensions are also looming large. A trade dispute involving President Trump and Colombia over potential tariffs further unsettled investors. Although Trump later paused these tariff threats, the uncertainty surrounding international trade continues to weigh heavily on market sentiment.

The Road Ahead

As we look forward, the upcoming Federal Reserve policy meeting will be another event to watch closely. Many investors hope for hints about possible interest rate cuts, which could further stabilize the markets. It’s important for everyone, from casual viewers of the stock market to seasoned investors, to keep an eye on how these developments unfold.

Market Snapshot

| Index | Performance |

|---|---|

| Dow Jones | Up 0.7% |

| Nasdaq | Down >3% |

| S&P 500 | Down nearly 1.5% |

| Nvidia | Down >17% |

In summary, the stock market’s mixed results demonstrate the complexity of these economic landscapes, with the Dow’s strength contrasting sharply against the significant losses among tech giants. Moving forward, how these trends play out will certainly be a focal point for investors and analysts alike.

Leave a Reply